Web3/crypto is attempting to build a new world enabled by blockchain technology - new technology, new currency, new trust signals - all with the goal of empowering and enriching people, not just corporations. But…it has a huge comprehension vacuum because of the technical and economic complexity of some of it’s financial products. Nature abhors a vacuum. Web3 project founders, many anonymous and their catchy memes are filling this vacuum…and parts of the crypto community worship them. I explore one such recent saga in crypto and the conditions that led to it.

A true crypto story

Sep 2021: A frog and a raccoon started a bank on the internet and promised to make everyone kajillionaires.

They called the bank “Wonderland”. Hundreds of thousands of adoring investors who called themselves “frog nation” invested in the bank.

Jan 2022: An anonymous caped crusader detective outed the raccoon as a convicted serial scammer who had served jail time. The raccoon and the 🐸 were accused of siphoning hundreds of millions in investor funds.

These are all facts.

How did they pull off the scam?

Through memes.

What?

Yes, first a little background on crypto. I will keep it simple.

Note: I am fascinated by crypto, decentralization and the benefits promised by it. I have invested in it. As a result, I have had courtside seats to the crypto circus. I also love (good) memes.

Crypto principles

Crypto/web3 has a couple key principles

Composability - ideas, projects and code are like lego blocks. You can borrow and piece them together as you please to build your crypto project without having to build yours from scratch. (too vague? It’s ok. I just use this concept for a punchline later. Not important for now)

Decentralization - no central authority, trust is ensured by code. “Code is law”.

Take normal (traditional) finance…

You invest money in a bank. They lend it out to make money. The bank has a lot of expenses: salaries for 1000s of employees, rent for their buildings, money to ensure regulatory compliance etc. So they give you a measly 0.5% interest rate.

Your funds are protected by the FDIC and the bank’s 20 page terms and conditions document. Nobody reads those, but you trust the credentials of the bank and FDIC to keep your money safe.

Now, take decentralized finance…

Products here have no buildings, no employees, no FDIC backing. The founders are usually anonymous internet people with cartoon profile pictures and names. The terms and conditions are written in code (called smart contracts) that anyone can read. And it runs on a worldwide computer (blockchain). You don’t have to trust anyone. “Code is law”: the code that runs a project is openly available, so you can check that yourself. They have no overhead costs, so they offer way higher interest rates. Like 10,000% APY. What?! Yes. Trustless, credential-less, decentralized. Welcome to defi.

Sounds neat. How did people get scammed? For that, let’s look into some aspects of crypto culture that made them ripe for exploitation.

Crypto culture

Everything is faster in crypto 🚀 - products ship faster, people become billionaires faster, people age faster. (Also probably why Vitalik, the founder of Ethereum is passionate about longevity science?)

Projects have agile, remote teams that build and ship stuff. There isn’t a culture of researching an idea, experimenting (financial viability, how people respond, risks etc.) to evaluate it, assessing launch worthiness and then launching. Billion dollar financial schemes with completely new models are conceptualized and launched in a matter of weeks. The idea is evaluated LIVE. on real people.

Anti-establishment, punk rock vibes 🤘

People are disillusioned with the status quo - traditional finance being stacked against the common man, inflation, mainstream media. Staying home during the pandemic and being in online echo chambers all day added fuel to this fire.

There is a strong desire for change

FOMO - the real currency that powers crypto

They’ve seen their friends make life-changing money through crypto. They want in. Coins on crypto have meteoric rises, so there is no time to research. You hear about a project…you ape in (invest first, think never). That’s the “degen way” (i.e. degenerate crypto gambler) - behavior that is romanticized in this space.

No rules. No regulations. It’s like a city without roads, speed limits or driver’s licenses.

With that setup, let’s talk about …

The power of memes

People long for community. The internet is the best community organizer. And it runs on memes (look at Doge coin - worth $18B because cute dog. Lolz. )

Memes = community = conformity

Some prominent crypto memes…

WAGMI: a rallying cry that means We’re All Going to Make It. (i.e. this coin / project we are investing will make us decakajillionaires)

NGMI: Not Going to Make It. Anyone who disagrees with my coin/project/point of view will not make it

HODL: Hold On for Dear Life. Also see diamond hands > paper hands. No matter what the numbers on the price chart tell you, if you follow your judgment as opposed to what influenzas or the founders of your defi cult want you to do, you have paper hands and will be shunned

Pseudonymity, anti-credentialing: You don’t ask about the background of a crypto founder or how reliable they are - “shut up, boomer!”, “you are ngmi!”

Memes >> Code

Remember how I said that you didn’t need to trust a central authority in defi, because you can just check the code? Well, here is the catch - the economics of these defi projects are (deliberately) NOT simple and nobody is going to sit and examine code.

So what do founders do to entice investors: catchy memes.

Memes are brilliant at abstracting and simplifying complex ideas…but they eliminate nuance. But they drive mass behavior.

Smart contracts are for programming blockchains. Memes are for programming the masses.

Memes >> due diligence

Also, unsound ideas gain legitimacy because otherwise legitimate voices retweet a meme (e.g. Elon Musk pumping Doge cos dog lolz).

Here is a defi example: The “(3,3)” meme took twitter by storm around Oct 2021 - It was for Olympus DAO (think of it as an online investing club) which had ambitions of becoming the reserve currency of the world (i.e. replace the dollar) by encouraging people to buy the ohm token (their currency), keep it deposited with them and buy more of their token family. They summed this approach with the catchy (3,3) and promised APYs (interest rate) of 10,000%+.

It was conceived off by the pseudonymous, 17 yr old, Zeus. The economics of it were complicated enough that most people didn’t bother to understand it. (See Jordi Alexander’s detailed breakdown.)

But the 10,000% APYs and (3,3) meme caught on and trusted, non-crypto native thought leaders tweeted it cos they wanted to be part of the party too. Legitimacy achieved! It spread like wildfire. “The birth of defi 2.0”, they said.

How did it go? if you invested $10,000 in it on Jan 5, 2022, you would have $~3k now. But great meme! Wagmi.

There you have it - the building blocks for mass programming.

Defi degens escaped the groupthink of mainstream for a new groupthink run by their meme overlords.

The Wonderland Ponzi

Wonderland used this playbook to perfection

2 founders: a cartoon raccoon and a cartoon frog.

One pseudonymous founder (named Sifu, after the raccoon from Kungfu Panda)

The 🐸 is Daniele Sestagalli (Dani), his linkedin profile pic is a frogman giving the middle finger, so … yay! so punk-rock!

An identity for their faithful followers: “frog nation”. Their investment thesis: “we are frog nation”

If you asked what the brave leader Daniele’s background was, you were shut up with the power of ngmi and shouted out of existence by 🐸 nation. (anti-credentialing)

The power of (3,3): They took the ohm (3,3) code, tweaked it and made it their own. So they rode the (3,3) meme, replaced it with (🐸, 🐸) and 🚀 to the 🌕. (composability! Yay! This is the punchline I mentioned earlier. If you didn’t like, you are ngmi).

Not so decentralized, not everything was coded: the keys to the treasury were in the hands of Sifu and Daniele. They can up and leave any time. Oopsie!

Yesterday, it was revealed that Sifu was a convicted serial scammer (aka Omar Dhanani aka Michael Patryn) - he ran a cryptocurrency ponzi called QuadrigaCX in Canada that was shutdown a few years ago and served time in the US for other scams prior to that.

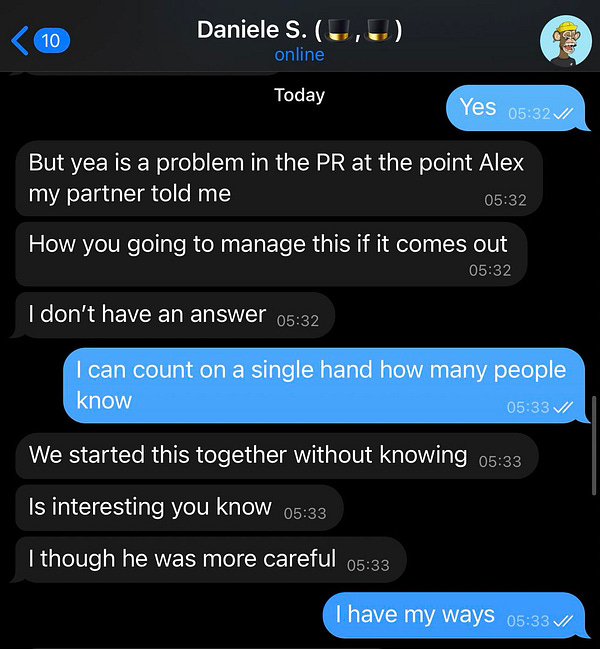

He along with Daniele have been accused of siphoning funds from Wonderland investors.

Daniele claimed he didn’t know about Sifu’s past until recently. So this bus full of frogs was being driven by one habitually drunk driver and one without a sense of smell. Both drivers took the loot and hopped off the bus while the frogs are chanting “wagmi” as it hurtles towards a cliff.

If you invested $10k in Wonderland on Jan 5, 2022, you will have ~$2k now. Neat!

So is crypto bad?

Speaking in absolutes never did anyone any good. - e.g. “web2 is evil”, “credentialing is bad”. Absolute positions are memes. They lack nuance, remember?

Evolution happens from acknowledging the role that some technology played, the problems it created and then thoughtfully solving it. Not by grandiose, absolute pronouncements that only result in pain for participants and hurt the bigger mission on hand.

A knife is a tool which in the hands of a surgeon can save lives. But in the wrong hands, it can take lives. Blockchain / crypto offers a compelling set of tools with an ideology for building the next version of the web. We need a way to simplify how we signal trust in a trustless web3 world so people can tell the surgeons from the robbers. Memes are not trust signals.

Word! Great post, it feels like it's time for some counter-culture that puts facts and logic first again. Otherwise this industry will never be taken seriously and eventually straight up die.